What Is the Post-Pandemic Reality for Lighting Distributors?

The global lighting industry come into a different reality after the pandemic—one defined not by convenience, but by complexity. For lighting suppliers crosswise the U.S., Mexico, Brazil, South Africa, and the Middle East, supply chains that formerly sensed trustworthy unexpectedly became impulsive and friable. What was formerly a smooth procurement course turned into a scramble for components, shipping containers, and production slots.

Raw materials for instance copper, aluminum, silicon wafers, and polycarbonate faced significant price unpredictability. These inputs are important for engineering street light photocells (dusk-to-dawn sensors, NEMA sockets, and Zhaga connectors), and when the prices of these materials fluctuate violently, the cost of manufacture becomes unsteady instantaneously. For suppliers, this meant pricing contracts with contractors and municipalities distorted before projects were even initiated.

At the same time, global logistics systems broke down. Seaports were choked, shipping containers were unreachable, and cargo costs swelled. Suppliers accustomed to four-to-six-week deliveries unexpectedly faced postponements elongating into months. Hardware for street illumination projects frequently arrived too late for tender deadlines or installation windows, placing whole community projects in risk.

Possibly the most destructive consequence, though, was the increase of undependable supply. Producers over-promised production volume and under-delivered. Orders were confirmed and then adjourned, partially achieved, or canceled outright. For suppliers, this destruction was not just operative—it was reputational. Metropolises, EPC suppliers, and utilities began questioning the trustworthiness of their sellers.

In the world of large-scale outdoor illumination, where thousands of photocells may be fitted in a single project, supply-chain fiascoes swell outward with dramatic impression. Missed deadlines meant infrastructure renovations stalled. Budget overruns became routine. Municipal confidence dropped. The pandemic did not simply slow supply—it exposed how susceptible low-cost sourcing strategies really were.

Why Does Supply Chain Stability Matter More than Ever?

1. Price Volatility Exposed the Weak Links

During the pandemic, supply chains were stress-tested internationally. Shipment costs poured up to five times, and scarcities of electronic components and raw materials triggered repeated price variations. Suppliers who worked with unsteady or single-source suppliers could not control expenses, update pricing fast enough, or protect margins.

Consequently, distributors learned that the inexpensive supplier is every so often the most costly when prices vary devoid of warning. Constancy in pricing and procurement is no more managerial—it is a strategic advantage that guards profitability.

2. Stock-Outs Mean Lost Market Share

In illumination distribution, accessibility equals credibility. Public and infrastructure projects work on stern timelines. When photocells are unobtainable, projects stops, and customers instantaneously shift to competitors who have stock.

Just the once trust is shattered by delays, distributors may lose not just one order—but the whole customer connection.

The data shows this clearly: a substantial portion of distributors lost sales simply because products were not available when desired. Product availability is now just as significant as product quality. Reliability unswervingly influences revenue.

3. Distributors Value Partners Who Manage Risks

Distributors no more look only at product price — they assess how well a supplier can defend their business from interruption.

Suppliers with varied raw material sources evade dependency on a single country, factory, or seller. When scarcities happen in one area, substitute sourcing keeps manufacture running. Similarly, international logistics networks permit consignments to be redirected when seaports, borders, or transporters fail.

Suppliers that uphold buffer inventory offer instant backup during unexpected demand spikes or supply disruptions. In the meantime, supple manufacturing allows rapid modifications in production volume, materials, or configurations devoid of lengthy delays.

For distributors, these systems mean less stockouts, less project postponements, and less emergency buying at magnified prices.

In brief: A resilient supply chain doesn’t just transport products — it absorbs shocks.

That is why a robust supply chain acts as risk insurance for distributors, protecting sales, repute, and profitability.

How Reliable Photocell Supply Chains Win Distributor Trust?

A strong supply chain is not just about delivering products — it is about delivering confidence. Distributors rely on foreseeable, acquiescent, and scalable suppliers to defend their repute and profitability. Here’s how reliable photocell supply chains build that trust:

1. Certification Consistency

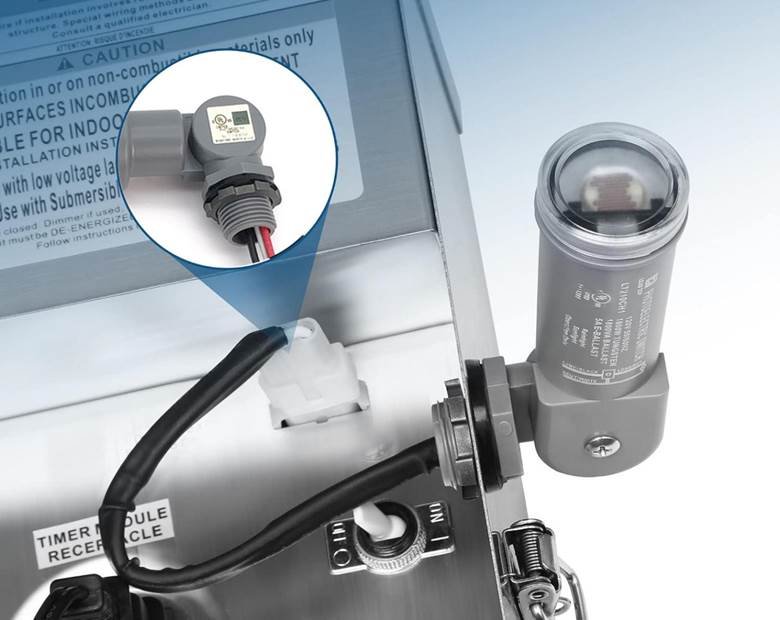

Certifications such as UL, CE, CB, and Zhaga promise that products meet international safety and performance criteria. When certifications are constant and up to date, suppliers can sell into numerous markets without acquiescence risks, customs delays, or project refutations.

2. Predictable Lead Times

Fast and correct delivery timetables permit distributors to obligate to project timelines with sureness. Dependable lead times avert job-site delays, contract fines, and emergency sourcing from untrustworthy alternatives.

3. Stable Pricing Strategy

Providers who uphold measured and transparent pricing guard distributor margins. Evading unexpected price variations helps distributors set quotations, manage pacts, and predict profits without fiscal surprises.

4. Scalable Production Capacity

High-capacity factories assure distributors that large, long-lated projects can be achieved without scarcities. The skill to scale volume as demand grows averts stockouts and fortifies the distributor’s repute for trustworthiness.

5. Customization without MOQ Barriers

Permitting branding, packing, and slight product alterations devoid of strict minimum orders gives distributors marketing suppleness without inventory risk. This makes it easier to assist different customer desires devoid of overstocking.

Case in Point: What is The Lead-Top Approach?

Unwavering supply chains do more than sustain production—they redefine the role distributors play in the market. Leading constructors such as Lead-Top Electrical (Zhejiang, China) symbolize a new customary in international distribution relationships.

With 5 million+ yearly exports and accreditations including UL773, ANSI C136.10/41, Zhaga Book 18, CE, CB, and ISO9001, Lead-Top Electrical offers a working model that permits distributors to scale securely.

Here is how stable suppliers reshape distribution strategy:

1. Consistent Supply Capacity

Constructers with scalable production infrastructure do not depend on presumption. They work with foreseeable output planning, automation, and inventory management systems. This permits suppliers to assertively bid on public bids involving thousands of units, knowing supply will not breakdown halfway.

Instead of rationing stock between customers, suppliers secure definite weekly or monthly allocations, guarding long-lasted fixings from distraction.

2. Flexible Customization

Custom branding used to be a luxury. Nowadays, it is vital. Producers proposing private labeling, packing adjustments, firmware configuration, and surge level customization give suppliers the tools to segregate in competitive markets.

Distributors no more resell common products—they carry custom-made solutions line up with regional desires and brand personality.

3. Faster Lead Times

Unchanging operations permit constructers to ship samples within 2–3 days and complete big orders within 7–15 days. This speediness transmutes a distributor from a submissive broker into a receptive supply partner.

Quick retort wins tenders. It averts project postponements. It builds self-confidence among suppliers and utilities.

4. Global Compliance

Accreditations are not optional—they are market access keys. A photocell short of UL, ANSI, or Zhaga acquiescence is effectually imperceptible to government bids.

Stable contractors invest in regulatory approvals before customers demand them. This guarantees suppliers do not lose tenders due to paperwork—and more significantly—do not risk product returns or blacklisting.

5. Product Reliability

When flagship models like LT134 are made with Zero-Crossing Detection, IP66/67 protection, and outpouring immunity up to 20KV, suppliers gain more than a product—they get a promise of performance.

With prolonged warranties (8 years or more), lesser failure rates, and reliable electrical performance, suppliers reduce post-sale support costs and evade reputation damage from field fiascoes.

Looking Ahead: What Does the Future Hold for the Industry?

Metropolitan growth across Latin America, Africa, and the Middle East is hastening. Metropolises are interchanging old-fashioned sodium lights with LED street systems, mounting infrastructure into new developments, and accepting smart illumination technologies.

| Urban Lighting Trend | Description / Impact |

| Metropolitan growth acceleration | Cities across Latin America, Africa, and the Middle East are expanding rapidly, increasing demand for modern public lighting systems. |

| LED streetlight adoption | Traditional sodium lights are being replaced by energy-efficient LED street lighting solutions to reduce power consumption and maintenance costs. |

| Infrastructure expansion | New commercial zones, housing developments, and road networks require large-scale outdoor lighting installations. |

| Smart lighting integration | Cities are deploying smart illumination technologies for remote monitoring, adaptive lighting, and energy optimization. |

The new era of distribution favors those who choose:

| Old Distribution Mindset | New Era Distribution Priority | Business Impact |

| Shortcuts in sourcing | Sustainability | Long-term supply security and responsible sourcing practices |

| Rush pricing and low bids | Reliability | Fewer delays, consistent quality, and reduced operational risk |

| One-time transactions | Partnerships | Stronger supplier relationships and strategic collaboration |

| Forecasting based on speculation | Stability | Predictable supply, pricing control, and business continuity |

Supply chain stability is no longer a competitive edge—it is the foundation of trust, profitability, and survival.

Conclusion: How Trust Is the New Currency?

In today’s post-pandemic market, distributors no more assess photocells based on price only. Recurrent supply chain interruptions, quality irregularities, and product letdowns have moved purchaser primacies from cost to reliability.

When distributors buying photocells, they are actually spending in certainty (assurance that products will perform as stated), stability (guarantee of reliable supply and quality), and long-lasted value (abridged failures, returns, and upkeep costs over time).

Producers and suppliers who provide trustworthy quality, transparent communication, and reliable delivery schedules build faith. That faith becomes a competitive edge, influencing repeat business and long-lasted partnerships.

In brief: In contemporary distribution, trust is more influential than price. The firms that earn trust don’t just secure sales — they secure their position in the prospect of the smart lighting industry.