Introduction: What Does the “Involution” of Photocell Manufacturing in China Really Mean?

In latest years, China’s photocell market has entered what many insiders call a phase of “involution” — a position where strong competition raises struggle and cost, but not value or differentiation. On paper, this appears good for purchasers: lesser prices, more suppliers, plentiful product selections. Though, in real business operations, this market atmosphere generates unseen complication and greater long-lasted risk.

Purchasers nowadays do not just buy components — they buy project dependability, monitoring acceptance, warranty assurance, and future compatibility. Unluckily, as producers race to offer the lowermost bids, the market more and more undergoes from:

- Quality unpredictability

- Abridged product lifecycles

- Certification shortcuts

- Supply chain unpredictability

- Lack of accountability after transport

For EPC contractors and suppliers, the photocell is not a small accessory — it is a control node inside a public asset network that may work for 8–15 years. When a low-cost photocell flops, it does not just need replacement; it initiates site visits, traffic cessation, labor cost, political objections, and warranty clashes.

So, the actual question is not “Who is cheapest?” but rather:

Who can support your project for its whole lifespan?

Why the Market Is So Crowded?

1. Low Entry Barriers

Photocells are structurally simple at an entry level, which makes production look deceivingly stress-free. A small workshop with uncomplicated injection molding and PCB assembly can technically produce a photocell within months.

Though, real engineering deepness is not in assembly — it is in dependability design.

As entrance is easy, contractors flood the market with:

- Appearance-focused models

- Manual adjustment products

- No surge design

- Generic housings

- Negligible aging tests

This leads to overproduction devoid of improvement — an unhealthy market where existence hinge on price cutting rather than technical dominance.

As a result, quality factories are compelled to contest against “garage-level” producers who can quote 30–50% lesser prices by:

- Avoiding incoming scrutiny

- Using reprocessed materials

- Evading acquiescence testing

- Decreasing PCB thickness

- Neglecting surge suppression

Short-term savings become long-lasted catastrophes.

2. Severe Product Homogenization

Most industrial units copy similar designs. Devoid of R&D investment, photocells across the market look alike — same covering, similar cable, identical structure.

What happens when there is no distinction?

👉 Price turn out to be the only weapon.

- Performance

- Durability

- Warranty strength

- Surge resistance

- System compatibility

Producers contest on:

- Who is low-cost

- Who promises quicker delivery

- Who offers greater discounts

This forms a faulty procurement atmosphere where purchasers relate only quotations — not failure rates.

Ultimately, low-price rivalry drives high-quality players either:

- Out of the market

- Into niche segments

- Or into export focus only

The local market becomes fake-busy but fragile.

3. Fragmented Customer Base

China’s photocell purchasers comprise:

- Wholesalers

- Export traders

- OEM streetlight industrial units

- EPC construction firms

- Smart illumination system integrators

- Government agents

Small producers try to serve everyone. This generates:

- No specialization

- No application understanding

- No technical supervision

- No documentation support

For instance:

An EPC contractor needs surge study, grid compatibility, and acquiescence documents.

A supplier needs steady SKUs, elongated warranty, demand projecting, and fast logistics.

A smart illumination platform needs Zhaga + D4i + communication protocols.

However many factories deliver:

👉 “One model fits all.”

Which in actuality means:

👉 “One mistake ruins all.”

4. Global Export Pressure

European and North American markets demand:

- UL

- CE

- ANSI

- IK & IP

- Zhaga

- D4i

- RoHS

- CB

Instead of elevating skill, many factories choose:

- Forged declarations

- Grey-market licenses

- Incomplete testing

- Accreditation under another factory’s name

This leads to a dangerous condition where:

- The consignment passes customs

- But flops onsite examination

- Or has warranty rejected

- Or disrupts insurance sections

Purchasers then discover too late:

Certification on paper does not equal acquiescence in actuality.

How Buyers Can Choose the Right Photocell Manufacture?

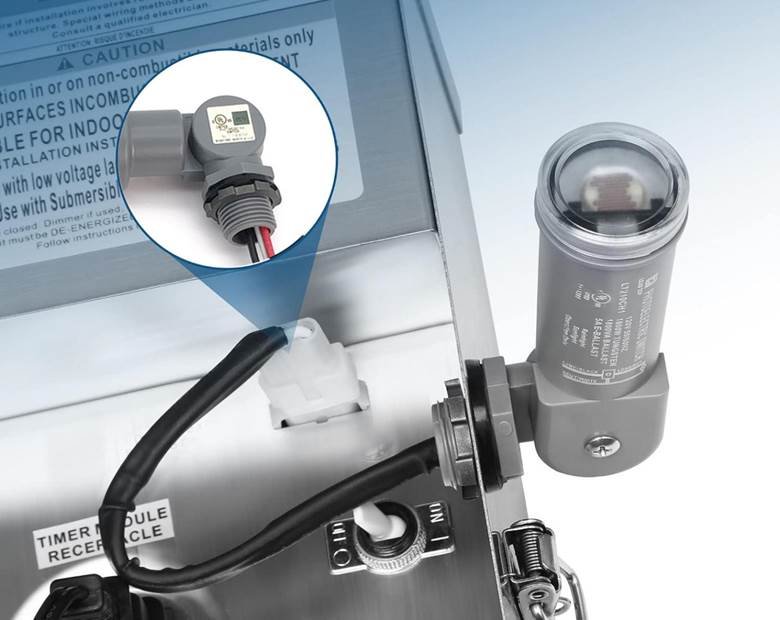

1. Check Certification Portfolio

Certification is not about pride — it is about project entitlement.

Devoid of:

- UL

- ANSI

- CE

- Zhaga

- CB

Your project may:

- Miscarry bid assessment

- Be disallowed at fitting stage

- Negated insurance

- Lose warranty protection

A thoughtful producer does not selectively certify one model.

They certify:

✔ Whole product series

✔ Production lines

✔ Factory management systems

✔ Quality control processes

Ask suppliers:

- Can you show original certificates?

- Are serial numbers perceptible?

- Who is the allotting body?

- Does certification match this exact model?

If responses are unclear — walk away.

2. Evaluate Technical Capabilities

Correct competency is seen inside the product.

Look for:

Zero-crossing detection

→ Guards LED drivers from current thwarts.

High surge rating (10kV–20kV)

→ Endures lightning and utility switching.

IR filtering

→ Averts sunshine intrusion.

IP67 sealing

→ Averts moisture-induced erosion.

UV-resistant housing

→ Delays yellowing and cracking.

Elongated warranty

→ Shows confidence, not marketing.

Example:

A professional model offering:

- IP67

- 1425 J surge defense

- Zero-crossing switching

- 8–10 year warranty

Is operating in a different category than entry products.

3. Verify Capacity and Delivery

Capacity is not volume — it is supply dependability.

A factory that manufacture:

- 5 million+ units yearly

- Runs automatic SMT lines

- Upholds buffer inventory

- Has perceptible batch systems

Will not:

❌ Interrupt consignments

❌ Alter designs mid-project

❌ Change components devoid of notice

❌ Miss tender timelines

Small industrial unit cannot absorb:

- Raw material shocks

- Certification postponements

- Logistics interruptions

Large projects need suppliers who can endure unpredictability.

4. Look for Customization and Support

Real partners support:

- Logo customization

- Branded manuals

- Barcode systems

- Tender documentation

- Acquiescence files

- Engineering consultation

Suppliers who cannot offer:

- Drawings

- Surge curves

- Aging tests

- Failure analysis

Are not partners — they are trading desks.

5. Review Reputation and Case Studies

A supplier trusted by:

- Utilities

- Governments

- International wholesalers

- EPC leaders

Has been:

✔ Audited

✔ Tested

✔ Challenged

✔ Proven

Ask:

- Where has your product been fitted?

- What environments?

- What voltage circumstances?

- What catastrophe rate?

- What is your main running project?

If the responses come with proof — continue.

If not — price is your only residual guarantee.

And price is the feeblest guarantee.

Buyer Guidelines by Customer Type: What Should Each Buyer Prioritize?

Wholesalers / Distributors

Focus on:

| Supplier Trait | Low Risk | High Risk |

| Certification | Multi-market | Single local |

| Supply | Multi-source | Single supplier |

| SKUs | Fixed | Random changes |

| Warranty | Long term | None |

| Pricing | Balanced | Unsustainable |

Evade suppliers who can only sell “low-cost today”.

Streetlight Manufacturers

Emphasis on:

- Docking compatibility

- Interface standards

- Customization capability

- Packing incorporation

- Delivery dependability

Evade platform mismatch.

EPC Contractors

Demand:

- Tender support

- Certification sets

- ≥8-year warranty

- Risk documentation

- Engineering consultation

Elude imperceptible factories.

Smart Lighting Platforms

Need:

- Zhaga

- D4i

- Communication compatibility

- Firmware roadmap

Conclusion: Why Is Avoiding the Low-Price Trap the Smartest Strategy?

Rivalry in China’s photocell market is violent — but not professional.

The noise is loud, the quotations are many, and the assurances are brave.

But only a hardly any of factories can deliver:

| Area | Professional Factory | Typical Low-Grade Factory |

| Compliance | Verified certificates | Verbal claims |

| Consistency | Process controlled | Random QC |

| Longevity | Tested | Untested |

| Accountability | Contract-bound | Avoided |

Cheap products lower invoice value.

Bad products raise total cost of ownership permanently.

Before promising to any supplier, ask:

- Can they protect my tender entitlement?

- Can they support certification claims?

- Can they honor warranty?

- Can they supply consistently for 10 years?

- Can they answer when problems arise?

If the answer is no — the price will never be low enough.