Introduction: Why Supply Chain Resilience Matters?

In today’s globalized market, supply chain resilience has become one of the most important success aspects in infrastructure development—mainly in public lighting projects where cutoff dates, acquiescence, and safety criterions are non-negotiable.

From the repercussion of the COVID-19 pandemic to continuing geopolitical encounters, trade limitations, and raw-material inflation, international supply chains have exposed their susceptibilities. Public establishments and EPC contractors once thought that sourcing components was as simple as placing orders with the lowest bidder. That time is done.

Photocells are not “small parts”—they are control systems. A illumination network is only as trustworthy as the photosensor that turns it on and off. A single uncertified or delayed photocell can avert system commissioning, delay payments, or even result in project termination.

Governments are reacting by narrowing procurement procedures. Bids progressively need suppliers and EPCs to exhibit not just product quality—but logistics readiness, accreditation, redundancy systems, and functioning scale.

In brief:

The main risk in contemporary projects is no more technology letdown—it is supply failure.

What are Global Photocell Market Dynamics?

The worldwide demand for photocells continues to rise as countries thrust for sustainability, smart illumination acceptance, and energy control technologies.

Regional Market Dynamics

North America

The U.S. and Canada enforce stern acquiescence requirements for example UL773, FCC principles, and ANSI C136 criterions. A supplier devoid of these certifications is mechanically disqualified from most community tenders.

Europe

European metropolises are moving toward Zhaga-D4i ecosystems, underlining interoperability between luminaires, nodes, and controllers. This entails photocell producers to support digital procedures and homogenous interfaces.

Middle East and Latin America

Projects are enormous, time-sensitive, and every so often politically driven. EPC contractors who flop to deliver components on time risk not only punishments but complete exclusion from upcoming government work.

Market Forecast

By 2030, the worldwide photocell market is predictable to surpass USD 3 billion. Though, suppliers capturing this development will not be the cheapest—but the most skilled, acquiescent, and operationally firm.

What Are the Biggest Risks in Photocell Supply Chains?

1. Raw Material Shortages

Microchips, sensors, resins, and surge defense components all depend on multifaceted global supply lines. Semiconductor scarcities caused multi-month project postponements crosswise street lighting renovations internationally.

Devoid of multi-sourcing strategies, a single unattainable IC component can shut down a whole production line.

2. Certification Bottlenecks

Certifications such as UL, CE, CB, and Zhaga are not elective—they are caretakers.

Projects have malformed simply because suppliers:

- Unsuccessful to uphold certification

- Submitted expired reports

- Used uncertified components

- Had mismatched test standards

Certification postponements can cause missed deadlines or cancelled orders even if products exist physically.

3. Logistics Delays

A workshop fault may affect one consignment. A shipping postponement may affect an whole metropolis project.

Extraordinary container rates, seaport jamming, customs holdups, and unsteady currency tariffs can shatter project timelines. Municipal projects do not stop because ships are late.

4. Supplier Over-Reliance

Single-source reliance generates convergence risk.

If your only photocell provider shuts down, experiences labor unavailability, or loses accreditation, your whole project pipeline breakdowns.

Building Resilience: What are Best Practices for EPCs & Governments?

1. Choose Certified Partners

Certifications verify:

- Electrical security

- Ecological sturdiness

- Surge confrontation

- Interoperability

A serious supplier must offer:

- UL773

- ANSI C136.41

- Zhaga Book 18

- CE / CB

- IK ratings

- IP sealing accreditations

These are not marketing tags—they are legal openings to project agreement.

Example:

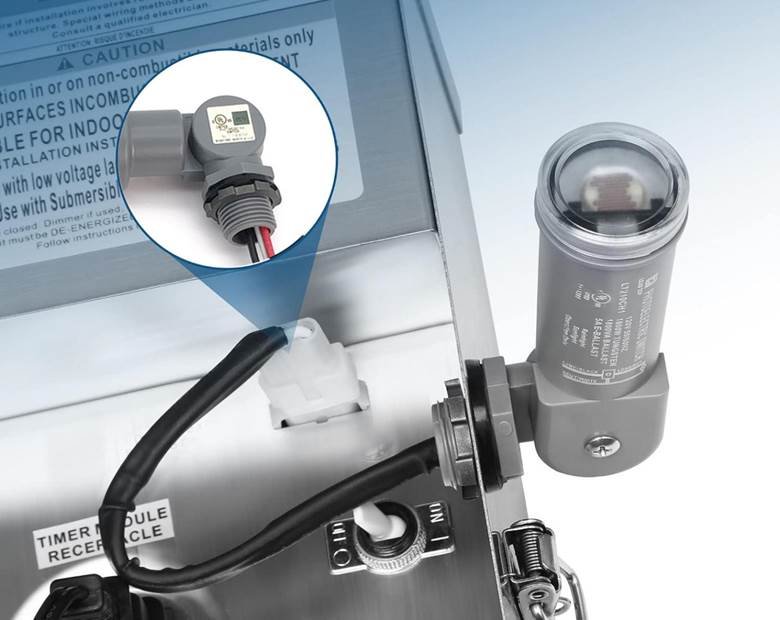

A photocell for example the LT134 proposing 20kV/10kA surge defense, zero-crossing detection, IP67 protection, and an 8-year warranty is made for outside infrastructure—not just domestic applications.

2. Demand Proven Capacity

A strong factory must validate:

- Monthly output capacity

- Mechanization scale

- Quality testing throughput

- Shipping volume history

Contractors shipping 5+ million units yearly show maturity in production supervision, labor apportionment, and logistics systems.

EPCs should require factory audits or documentation during pre-qualification.

3. Prioritize Flexibility and Customization

Different projects demand different:

- Switch-on lux thresholds

- Surge ratings

- Cable lengths

- Colors and labels

- Connector types

A producer with built-in customization capacity averts:

- Installation postponements

- Acquiescence mismatches

- Redesign costs

Quick reaction times—such as 2-3 day sampling and 7-15 day production—make a difference between winning tenders and missing cutoff date.

4. Diversify Geographies

Governments must boost EPCs to source from multiple regions.

A resilient supplier network often comprises:

- Asia-based production

- International export hubs

- Numerous logistics routes

- Regional warehouse partnerships

Diversification decreases exposure to:

- Political uncertainty

- Currency controls

- Trade bars

- Natural calamities

What Do Real-World Case Studies Teach Us?

Case A: What Happens When EPCs Choose Only Price?

An EPC contractor sourced photocells from a cheap supplier missing UL certification.

Outcome:

- Pre-qualification letdown

- Tender refusal

- USD 5 million project loss

The fiscal harm was not due to equipment botch—but certification failure.

Case B: Why Did a Certified Supplier Win Instead?

Another EPC partnered with a supplier proposing:

- UL

- CE

- Zhaga

- Valid acquiescence documentation

- Stable capacity

Outcome:

- Project approval protected

- Delivery ahead of schedule

- Strong municipal relationship established

Reality: Acquiescence wins bids. Trustworthiness wins reputes.

Conclusion: Why Must Governments and EPCs Act Now?

The prospect of lighting is smart, data-driven, and interconnected. None of this works devoid of dependable components.

Governments Must:

- Make certification compulsory

- Score sellers on supply resilience

- Punish capacity misrepresentation

- Require documentation audits

EPC Contractors Must:

| Operational Focus | What This Protects Against | Long-Term Benefit |

| Annual auditing | Scam, poor production criterions | Assured supplier reliability |

| Batch testing | Unseen quality difference | Abridged warranty exposure |

| Surge/IP validation | Ecological harm | Greater system dependability |

| Supply diversification | Logistics failure | Continual project delivery |

Photocell Manufacturers Must:

| Focus Area | Business Impact | Operational Advantage |

| Automation | Greater production precision | Lesser fault ratios |

| Raw materials | Production constancy | Price control |

| Logistics | Quicker fulfillment | International market admittance |

| Compliance | Tender admissibility | Customer belief |

Final Takeaway: What Determines Success in Municipal Lighting Projects?

Success is not decided at installation. It is decided during:

- Supplier selection

- Accreditation verification

- Logistics planning

- Capacity confirmation

- Acquiescence integrity

In the smart city age, photocells are not elective sensors—they are infrastructure assets.

The prospect belongs to EPC contractors and governments who spend not only in illumination technology—but in supply chain intelligence.