Introduction: What Is the Post-Pandemic Reality for Lighting Distributors?

For lighting distributors globally, the COVID-era supply shockwave was more than just an interruption — it was a central rearrangement in how buying decisions are made. Before the pandemic, the international illumination market mainly functioned under one prevailing rule: whoever offered the lowermost unit price generally won the order. Photocells were every so often treated as simple, low-risk components, and procurement squads focused deeply on cost-per-unit instead of supply certainty.

Then the whole thing changed.

Seaports closed or slowed surprisingly. Containers were left aground for weeks. Freight costs gushed to historic levels. Factories faced labor shortages. Even something as routine as landing a shipment of photocells became unpredictable. For many suppliers, shelves went empty while project deadlines remained firm. Metropolises and EPC contractors were not interested in pandemic excuses — they still projected lighting systems to go live on time.

In reply, suppliers were forced to rethink what “value” really meant.

Rather than pursuing the low-priced supplier, companies began seeking:

- Steady supply chains

- Dependable lead times

- Reliable quality

- Transparent certification

- Backup manufacturing capacity

The result is a structural change that continues today: a trustworthy and stable photocell supply partner is now far more valued than the lowest bidder. Cost still matters — but cost devoid of trustworthiness is no more acceptable.

Why Does Supply Chain Stability Matter More than Ever?

Supply chain consistency is no longer an operative detail concealed behind procurement departments. It has become a boardroom topic, unswervingly interconnected to profit margins, purchaser belief, and long-time feasibility.

Price Volatility Exposed the Weak Links

When freight rates swelled instantaneously and raw material deficiencies became common, distributors discovered which sellers sincerely controlled their supply chain — and which merely were middlemen.

Some importers faced:

- Unexpected price variations with no cautioning

- Unexplained invoice increases

- Incomplete shipments and void production slots

- Suppliers demanding advance payment for materials

At the same time, many low-cost suppliers unsuccessful to honor price contracts. Agreements written during constant periods distorted during chaos. Suppliers that hinge on a single low-cost industrial unit became economically susceptible overnight.

This period shown a critical lesson:

A low price that cannot be upheld is not a low price at all.

Suppliers with long-lasted sourcing contracts, multiple vendors for critical components, and strong logistics networks were able to stabilize pricing even during dangerous situations. Suppliers progressively view steady pricing as a form of imperceptible value — one that defends profitability even when markets vary.

In today’s world, steadiness in pricing and procurement is no more a convenience. It is a competitive advantage.

Stock-Outs Mean Lost Market Share

In distribution, inventory is opportunity. When suppliers cannot transport, opponents can — and consumers remember who failed them.

A late photocell shipment can:

- Stall an whole smart street illumination project

- Cause contractual fines for EPC contractors

- Cause warranty claims

- Force users to enduringly change suppliers

Community bids offer no lenience for missed deadlines. One time a distributor flops to deliver during a project phase, self-confidence collapses. End users do not return easily.

Industry surveys during 2021–2022 showed more than 60% of distributors lost business due to unreliable component supply.

Stock-outs change quickly into revenue loss, repute damage, and future opportunity loss. For this reason, distributors now treat trustworthy delivery as vital infrastructure — not just operative ease.

Distributors Value Partners Who Manage Risks

Risk no more goes only to producers. Nowadays, risk flows parallel across the whole supply chain.

Distributors now favor suppliers who:

- Uphold numerous sources for critical materials

- Control production scheduling within

- Own or partner directly with logistics providers

- Hold buffer stock during market instability

- Spend in testing infrastructure

These suppliers are not just sellers — they are operational partners.

When interruption happens, trustworthy suppliers:

- Communicate timely

- Offer alternatives

- Offer partial consignments

- Modify schedules

- Protect key accounts

The finest suppliers are those who remain steady not when circumstances are perfect — but when everything breaks.

For distributors, a robust supplier acts like risk insurance.

Why Is the Industry Shifting from Cost-Cutting to Value-Building?

During the pandemic, distributors began relating two outcomes:

- Firms who bought inexpensive and suffered uncertainty

- Firms who paid somewhat more but delivered on time

The difference became clear: the lowermost cost is not the lowermost risk.

The industry has now generally adopted a new way of thinking:

| Before Pandemic | After Pandemic |

| How inexpensive is it? | Is supply definite? |

| Can pricing be squeezed? | Can quality be trustworthy? |

| Fast profit | Long-lasted dependability |

| Vendor mindset | Partnership mindset |

Distributors are no more chasing for transactional relationships. They seek:

- Constancy

- Trustworthiness

- Certainty

- Partnership

This development reflects a wider truth across international trade:

Value-based sourcing is swapping cost-driven procurement.

How Reliable Photocell Supply Chains Win Distributor Trust?

Trust is built through conduct, not claims. The most dependable suppliers establish reliability through operations.

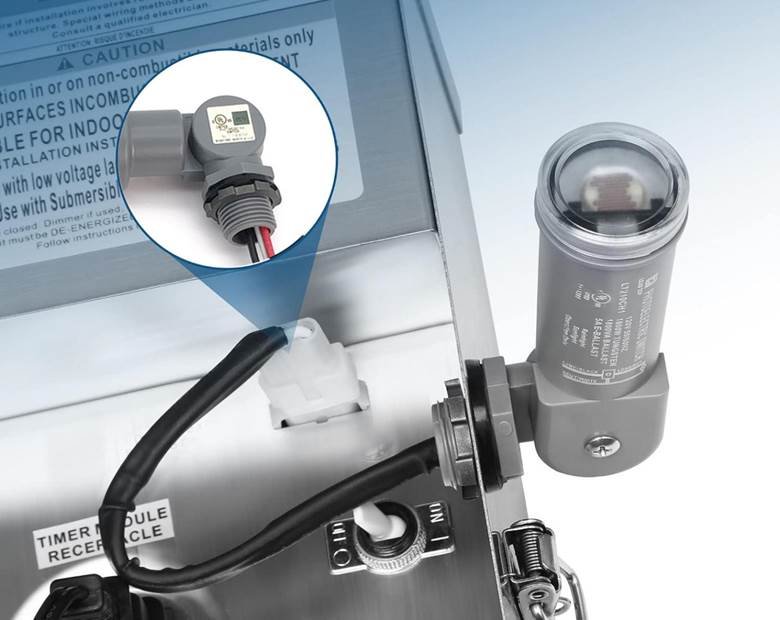

Certification Consistency

Photocells are safety-critical components. Without certification, distributors risk:

- Botched inspections

- Project terminations

- Liability exposure

Constantly certified suppliers offer:

Distributors no more gamble with non-acquiescent products. Certification is not elective — it is foundational.

Predictable Lead Times

Late supply harms trustworthiness. Consistent delivery generates growth.

Dependable partners:

- Transport samples within days

- Meet bulk order cutoff date

- Communicate variations timely

- Uphold logistics visibility

For distributors, expectable transport is more valued than fast shipping. When timelines match reality, planning becomes possible.

Stable Pricing Strategy

- Abolish margins

- Confuse clients

- Halt tender promises

Distributors progressively favor:

- Transparent pricing

- Long-lasted contracts

- Steady cost structures

Suppliers who evade panic-driven pricing are trusted more — even if their price is to some extent higher. Stability wins loyalty.

Scalable Capacity

Distributors do not want to change suppliers as business nurtures.

Industrial unit manufacturing millions of units yearly:

- Absorb demand spikes

- Support extensive projects

- Scale quickly

- Uphold quality constancy

Capacity = confidence.

Customization without MOQ barriers

Branding matters. Packing matters. Localization matters.

Suppliers who:

- Support custom logos

- Adjust housing colors

- Provide tailored packaging

- Offer language-specific documentation

… Authorize distributors to scale their individuality without inventory risk.

Why Does the Lead-Top Model Demonstrate Supply Chain Excellence?

Lead-Top has made its industry repute by engineering trustworthiness into its supply chain.

Through:

| Area of Operation | Lead-Top’s Approach | Result for Distributors |

| Licensed manufacturing | Production line up with international standards | Guaranteed acquiescence and market entree |

| Resilient testing protocols | Multi-stage quality authentication process | Constant product trustworthiness |

| Bulk production | Millions of units yearly | Definite availability at scale |

| Long-lasted material partnerships | Strategic sourcing contracts | Constant quality and pricing |

| Logistics planning | Structured international shipment synchronization | Foreseeable distribution schedules |

… Constancy is not promotional language — it is working reality.

With:

- Millions of units transported per annum

- Multi-standard accreditation

- Foreseeable lead times

- Suppleness during interruption

Lead-Top denotes what distributors now anticipate from contemporary suppliers:

👉 Consistency, not excuses.

Conclusion: Why Is Trust the New Currency in Lighting Distribution?

Distributors are no more purchasing only photocells.

They are purchasing:

- Promise

- Certainty

- Constancy

- Self-confidence

Every consignment is a signal. Every distribution builds or corrodes trust.