In this day and age of swiftly growing lighting industry, a very few aspects have impacted market dynamics as expressively as shifting U.S. lighting tariffs. For last many years, trade rigidities and varying economic policies have headed to volatile tariff adjustments on imported electrical components including photocell controllers, lighting sockets, and smart sensors.

These tariff instabilities have done more than increase import costs; they’ve redesigned how U.S. constructors, contractors, and municipalities source and position outdoor lighting technology. From photocell controller pricing to smart lighting competition, the whole value chain is experiencing renovation. Companies like Lead-Top, which combine global manufacturing flexibility with vigorous acquiescence and modification, are evolving as strategic partners in this new trade-driven environment.

Tariff Pressures on Component Imports

The international supply chain for lighting control systems from the last many years depend on foreign manufacturing. A huge proportion of photocell controllers and smart lighting components are manufactured in Asia, where economies of scale and lesser labor overheads factually enabled U.S. suppliers to uphold competitive pricing.

Though, latest U.S. lighting tariffs have interrupted this equilibrium. Reliant on product sorting and origin country, tariffs on electronics can presently range between 10% and 25%, considerably swelling import costs for American consumers. Machineries that one time arrived at steady, low-duty rates today face steep prices, compelling suppliers to reconsider sourcing strategies and budget allocations.

All this leads to OEMs (Original Equipment Manufacturers) and city developers to reassess supply chains with a revamped focus on tariff-efficient logistics. Contractors talented enough for offering hybrid production, with manufacturing spread across tariff-friendly regions such as Southeast Asia, Mexico, or Taiwan, are increasingly preferred partners. This divergence not only decreases direct exposure to U.S.-China tariff volatility but also improves delivery constancy and after-sales service.

For instance, numerous American metropolises and infrastructure workers now highlight suppliers that can offer “dual-origin” or tariff-mitigated manufacture options. This flexibility supports cities to uphold steady project budgets even amid international trade precariousness.

Adjusting Market Strategy and Pricing Models

As tariffs vary, so do business models. The old-styled year-to-year procurement cycle no longer offers the pricing security that contractors and municipalities need. Consequently, various lighting integrators are accepting multi-year procurement contracts to get constant pricing and decrease exposure to future tariff hikes.

Furthermore, certain U.S. suppliers are starting regional warehousing to curtail lead times and minimalize the financial effect of currency changes and cargo additional charge. These regional logistics hubs permit companies to store photocell controllers and other lighting accessories locally, refining responsiveness to project schedules and government bidding timelines.

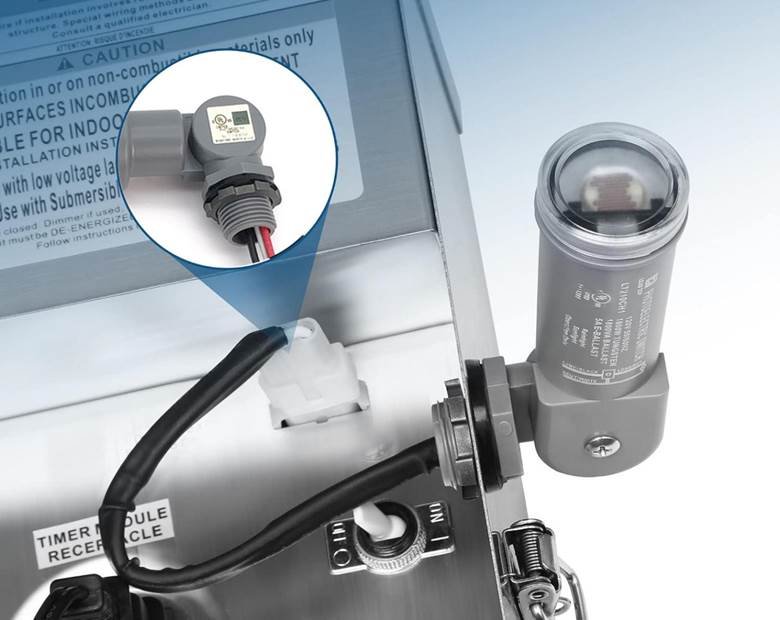

For constructers, the attention has moved to modular and customizable product designs that offer numerous applications underneath one SKU. A multi-voltage photocell controller that supports 120–480V input, can be positioned in both domestic streetlights and industrial parking areas. This flexibility cuts the need to store separate single-voltage models, so cutting inventory and transportation costs — a vital gain when tariffs make every shipment further expensive.

Compatibility has also turn out to be a strategic primacy. Products that can fit into both NEMA and Zhaga socket standards allow U.S. consumers to integrate controllers across diverse fixture types, improving system flexibility and decreasing installation difficulty.

Eventually, adaptableness in both pricing and product design has become a important differentiator. Producers who can uphold steady photocell controller pricing in spite of changing import costs are placing themselves as leaders in the growing U.S. market.

How Innovation Offsets Cost Increases

Though tariff pressures rise material and logistics expenses, technological novelty is assisting to reestablish balance. Progressive photocell controllers now include smarter features that bring long-standing functional savings far over and above the effect of initial price increases.

For instance, present designs often contain:

- Zero-crossing detectionreduces influx current and extends both controller and LED driver lifecycle.

- High surge protection (10kV–20kV) to protect against electrical turbulences and lightning incursions, mainly important for large-scale city lighting.

- Programmable lux and timing settings, permitting for tailored dusk-to-dawn operation that bring into line with local daylight cycles and energy goals.

These features leads to energy proficiency, maintenance saving, and elongated service intervals — three critical metrics for municipal and commercial lighting projects. A controller that continues five years longer or decreases yearly energy consumption by even 5–10% can effortlessly counterweight any extra tariff-related import cost.

The evolution of smart lighting systems and IoT-connected controllers additionally reinforces this cost-offset argument. Through actual data analytics, these controllers permit remote monitoring, automatic reducing, and predictive maintenance. Towns can improve energy usage and identify failures rapidly, decreasing the need for labor-intensive inspections and reactive repairs.

Consequently, towns are progressively observing photocell controllers not just as simple switching devices but as essential components of intelligent infrastructure. This progression permits contractors to uphold market demand even as U.S. lighting tariffs raise initial procurement costs.

The New Competitive Landscape

The U.S. outdoor lighting market is becoming more selective and sophisticated. Old-styled, low-cost photocells that carry out a single function are being substituted by multi-voltage, ANSI-compliant, and smart-ready controllers. Cities, utilities, and suppliers now demand components that come across rigorous security and performance standards such as ANSI C136.10 and UL773.

This transferal has formed a new hierarchy among contractors. Those proficient enough of merging tariff flexibility, technical innovation, and standards compliance are evolving as the top-tier providers. Companies that depend specially on low-cost imports without noticing tariff risks or performance demands are losing ground.

In this time of competitiveness, Lead-Top has placed itself as a trustworthy partner for smart lighting integrators. The company’s portfolio comprises of multi-voltage photocell controllers, smart sensor modules, and customizable sockets, all designed for compatibility with up-to-date LED fittings and networked lighting systems. By upholding numerous production bases and guaranteeing full ANSI and UL acquiescence, Lead-Top offers a real solution to the challenges posed by tariff uncertainty.

Furthermore, the company’s focus on longstanding dependability, flexible logistics, and after-sales support helps American suppliers and contractors uphold reliable quality and delivery performance — even during ongoing trade and pricing volatility

Conclusion

The landscape of the U.S. outdoor lighting industry is being redesigned by unending tariff fluctuations. What primarily looked as a pricing complication has become a catalyst for novelty, effectiveness, and smarter sourcing decisions.

As import costs increase, builders and integrators are reacting with technological improvements, modular product design, and diversified supply chains. These strategies not only lessen tariff effect but also develop the general quality and intelligence of America’s lighting infrastructure.

Eventually, the leaders in this growing market are those who adjust. By combining multi-voltage flexibility, smart-ready technology, and tariff-efficient manufacturing, companies like Lead-Top demonstrate how pliability and novelty can prosper under varying trade conditions.

Even as global trade policies continue to shift, one fact remains clear: the drive toward efficient, intelligent, and tariff-resilient street lighting systems will continue to define the future of the U.S. lighting market.