Introduction: How Is Smart Lighting Redefining Distribution?

The lighting industry is going through one of the most noteworthy revolutions in its history. What was once a basic utility service—simply providing lighting at nighttime—has now progressed into a refined technological system that supports sustainability goals, digital infrastructure, and smart city development.

In current metropolitan surroundings, streetlights are no more just poles with bulbs. They are intelligent devices entrenched into the digital fabric of municipalities. These contemporary illumination systems now host sensors, interconnect through wireless networks, report power consumption, and work together with integrated control platforms. They work as fundamental nodes in metropolitan data ecosystems, skilled of improving public protection, handling traffic, preserving energy, and shaping ecological strategies.

For illumination suppliers and wholesalers, this conversion carries both prospect and pressure.

On one hand, demand for smart lighting solutions is growing crosswise continents. Administrations want proficiency, suppliers want interoperability, and metropolises want flexible platforms that will not become outdated inside five years.

On the other hand, competition is increasing. Customers no more compare suppliers only on price. In its place, they ask more complex questions:

- Are the products globally licensed?

- Will they incorporate with my prevailing system?

- Are they upgradeable?

- Will they meet government bidding standards?

This change has redrafted the guidelines of market entry and survival. In the smart illumination age, the suppliers who succeed will not be the ones selling the inexpensive equipment—but those providing self-confidence, compatibility, and steadiness.

Why NEMA and Zhaga Standards Matter?

The base of smart illumination is not separable devices. It is systems that work together.

This is where NEMA and Zhaga standards become vital strategic tools instead of technical details. They outline how devices tangibly connect, interconnect digitally, and coincide crosswise producers and platforms.

Suppliers who line up with these criteria gain something much more valued than inventory—they gain access.

How Does NEMA Function as the Passport to the North American Market?

In North America, NEMA receptacles—defined by ANSI standards C136.10 and C136.41—form the mainstay of smart illumination placement. Any streetlight system that purposes to function in the United States, Canada, or Mexico must conform with these standards to be recognized by metropolises and utilities.

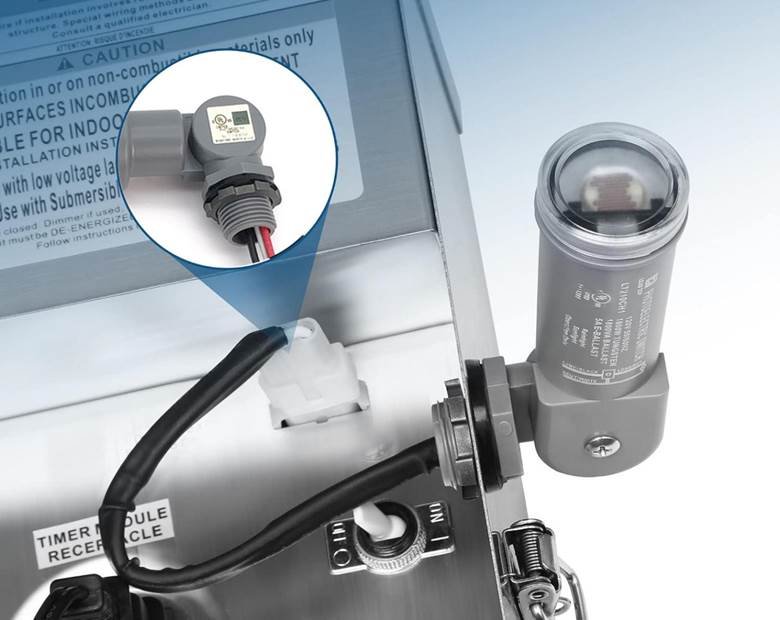

NEMA connectors come in 3-pin, 5-pin, and 7-pin configurations, all allowing different control abilities such as dimming, diagnostics, and communication. This system permits a “plug-and-play” environment where photocells, wireless controllers, and smart nodes can be mounted or substituted devoid of altering the luminaire itself.

Urban maintenance squads depend on this modular methodology because it:

- Cuts downtime

- Simplifies advancements

- Lowers training requirements

- Averts vendor lock-in

In the same way important is accreditation. Products made for the North American market are anticipated to meet:

- UL773 safety certification

- ANSI mechanical and electrical acquiescence

Without these accreditations, a product may be technically extraordinary—but lawfully unmarketable.

For suppliers, this means one thing: if you do not offer NEMA-compatible devices, you are not contending in North America.

On the other hand, suppliers who stock licensed NEMA products place themselves as project enablers. They permit suppliers to bid on projects with self-confidence, knowing they meet monitoring requirements from the start.

How Does Zhaga Act as the Global Language of Interoperability?

While NEMA rules North America, Zhaga Book 18 is becoming the international basis for modular smart lighting.

Zhaga was produced to homogenize interfaces between mechanical, optical, and communication components crosswise brands. It outlines not only how devices connect physically—but also how they communicate and work within illumination systems.

Zhaga’s acceptance has surged across:

- Europe

- Middle East

- Southeast Asia

- Latin America

Its demand lies in its smallness and adaptability. Not like NEMA’s external connectors, Zhaga nodes are frequently fixed directly onto luminaires—forming a clean, compact structural design that suits contemporary redesign priorities.

The development of Zhaga-D4i Alliance takes this even more.

Zhaga describes physical connectivity. D4i defines digital language.

Together, they produce an integrated illumination environment where sensors, drivers, and luminaires communicate flawlessly—irrespective of brand or country of origin.

This matters greatly for suppliers.

With Zhaga and D4i, suppliers eradicate:

- Compatibility quarrels

- Firmware mismatches

- Vendor dependency

- Risk of outdated hardware

Instead, they supply systems that are open, flexible, and upgradeable.

Suppliers proposing Zhaga-D4i acquiescent products efficiently speak the “global language” of smart illumination. Their addressable market rapidly inflates outside borders.

What are Three Ways by Which Distributors Gain Value?

Selling hardware is easy.

Selling outcomes is profitable.

The contemporary purchaser wants proficiency, not just equipment.

When distributors offer:

- UL, CE, CB-certified equipment

- Plug-and-play systems

- Smart-ready architecture

They decrease complication for clients.

Contractors install quicker. Engineers design simpler. Metropolises decrease approval cycles. Suppliers proposing homogenous products do not just deliver inventory—they carry project victory. This swing transmutes distributors into solution partners rather than vendors.

1. Why Are Distributors Moving From “Selling Products” to “Delivering Solutions”?

In the past, illumination delivery worked under a simple model: buy inventory at the lowermost possible cost and resell it at a margin. Price competition controlled the industry, and the distributor’s role was mainly transactional. Though, the smart illumination uprising has totally altered client expectations.

Today’s purchasers are no more looking for just a photocell, socket, or controller. They are looking for a whole system that works dependably from day one and remains well-suited for years. Cities, EPC contractors, utility firms, and smart city developers are now managing long-life infrastructure investments, not short-term purchases. This change has transformed procurement priorities.

Instead of asking “How much does it cost?” consumers now ask:

- Will it pass government checks?

- Will it incorporate with my prevailing system?

- Can it support future advancements?

- Will it work with smart illumination platforms?

This is where certification becomes a competitive advantage. Suppliers who offer UL, CE, and CB-certified products eliminate friction from the approval process. When project examiners diagnose familiar accreditations, installations move forward with sureness instead of delay.

One more main demand is plug-and-play engineering. Suppliers want systems that install effortlessly with negligible configuration. They want to evade field wiring errors, controller unsuitability, and needless overtime. Suppliers that offer uniform connections like NEMA and Zhaga remove technical risk for installers.

Possibly most significant is future compatibility. Smart illumination is a fast-moving sector. What works today may be obsolete in two years. Consumers now favor systems that can accept improvements—new controllers, new sensors, new communication protocols—without substituting the whole luminaire. Distributors proposing NEMA and Zhaga-compliant equipment permit this modular design.

By providing standard interfaces, licensed components, and upgrade-ready products, suppliers evolve from resellers into solution partners. Rather than merely distributing products, they help customers:

- Design systems

- Pick technologies

- Decrease fixing time

- Evade long-lasting risks

This methodology not only rises sales value—it builds relations that last across multiple projects.

2. How Does Reducing Inventory Risk While Maintaining Stable Supply Improve Profitability?

Inventory is both an asset and a liability for distributors. Stock that transports rapidly supports development. Stock that sits idle drains cash, occupies space, and ultimately becomes outdated.

In the illumination industry, obsolete inventory becomes useless fast due to varying standards, accreditation updates, and new interfaces. This problem deteriorates when suppliers bring numerous unharmonious models, each mandatory for different fittings, areas, or producers.

Standardization is the solution.

When suppliers move toward NEMA and Zhaga standardized interfaces, inventory becomes supple rather than brittle. One socket can support numerous controllers. One luminaire platform can receive countless sensors. This melodramatically decreases warehouse complication.

Rather than handling dozens of niche SKUs, distributors can stock lesser items while serving more applications. This leads to:

- Abridged dead stock

- Minor write-offs

- Quicker inventory turnover

- Stress-free estimating

- Improved working capital management

Standardization also defends suppliers against supply chain interruptions.

During the pandemic, numerous suppliers revealed that supplier dependency is dangerous. When one source botched, whole product lines vanished. But suppliers that used homogenous products had options. They could switch suppliers devoid of reforming systems or changing fittings.

Suppliers who partner with producers proposing foreseeable lead times, committed manufacturing capacity, and steady quality gain long-lasted confidence.

Post-pandemic, dependability is appreciated more than low price. Clients now choose partners who can deliver constantly rather than cheaply.

3. How Can Distributors Profit From Smart City and EPC Project Expansion?

Street illumination is no more an isolated infrastructure. It is now a critical element of urban digital environments.

Contemporary smart streetlamps are being used as platforms for collecting and communicating data across metropolises. The power connected applications that improve daily life and reduce operational cost.

Smart lighting systems now support:

| Smart Lighting Capability | Description / Purpose |

| Ecological monitoring | Measures pollution, moisture, and temperature to support ecological administration and public health planning. |

| Traffic examination & control | Collects data on automobile and pedestrian movement to increase city traffic movement and decrease congestion. |

| Security surveillance integration | Allows connection with cameras and security systems to improve communal security and monitoring. |

| Public Wi-Fi & communication networks | Offers wireless connectivity for inhabitants and supports IoT device communication. |

| Remote maintenance diagnostics | Permits actual monitoring of errors, decreasing downtime and upkeep costs. |

| Energy managing systems | Tracks power consumption and enhances illumination proficiency to lower energy consumption. |

These abilities have raised illumination from an operative expense to a strategic asset.

Extensive deployments are now led by EPC contractors and administration agencies. These administrations require systems that scale crosswise thousands of places while upholding unvarying performance.

EPC bids progressively specify:

- NEMA connectors

- Zhaga Book 18 interfaces

- Digital control standards

- Remote monitoring capability

- Interoperability

Distributors who propose acquiescent products efficiently hold the key to entitlement. Devoid of standard acquiescent equipment, sellers cannot bid. With it, they contend for billion-dollar infrastructure programs.

By bringing homogenous components, distributors:

| Distributor Advantage | Business Impact |

| Timely project assignation | Distributors become involved at the planning stage rather than only delivering at the end. |

| Influence over system design | Aptitude to recommend standards, components, and configurations used across the project. |

| Locking volume contracts | Greater sales volumes through long-lasted, large-scale agreements. |

| Involvement in infrastructure rollouts | Access to nationwide and regional smart city projects and extension programs. |

Moreover, smart city projects are long-lasted programs. Captivating one project frequently leads to:

- Follow-on growths

- Maintenance agreements

- Upgrading cycles

- Platform renewals

Why Emerging Markets are The Next Blue Ocean for Distributors?

Latin America

Mexico and Brazil are revolutionizing swiftly. LED retrofitting and smart renovations are hurrying.

Huge infrastructure budgets generate scale.

Middle East

The UAE and Saudi Arabia lead with mega-city spirits.

Smart illumination is foundational—not elective.

Zhaga-D4i is becoming policy.

Africa

Energy shortage forces proficiency.

Photocell acceptance decreases waste.

Emerging markets favor distributors who arrive ready with standards.

Conclusion: Why Is Certification, Standards, and Stability the Formula for Distributor Leadership?

The future belongs to distributors that line up on three principles:

1. Certification: shapes faith.

2. Standards: unlock opportunity.

3. Stability: guarantees survival.

Together, they build authority.

NEMA and Zhaga are not just interfaces — they are strategic weapons.

Distributors who position them now will govern tomorrow.