2026 Tariff Adjustments: What about Policy Background and Industry Context?

The announcement of 2026 tariff reductions marks a noteworthy policy swing with direct effects for the international illumination market. Effective January 1, 2026, China’s Customs Tariff Commission will implement special tariff rates on a extensive range of imported goods, containing lighting related products, sourced from 34 states and regions under 24 trade agreements.

For the lighting industry tariffs landscape, this policy reveals a constant effort toward trade liberalization and deeper integration with regional supply chains. While tariffs may seem to be a macroeconomic apprehension, their impact is felt most substantially at the product and project levels—mainly for outdoor lighting products and their critical control components.

Lesser tariffs can impact sourcing strategies, pricing structures, and competitive positioning. Though, they also build up competition by pull down barriers for overseas contractors, reshaping how producers and project stakeholders define value.

The 2026 tariff plan is part of China’s long-lasted trade strategy focused on high-quality development instead of volume-driven progression. By selectively applying special rates, officials objective to encourage proficient supply chains, acquiescence with global standards, and high-tech maturity.

From an industry viewpoint, these changes reinforce the actuality that tariff protection is no more the key driver of competitiveness. In its place, the policy environment helps producers that can deliver dependable, homogeneous, and engineering-driven solutions—predominantly in sectors such as outdoor lighting control, where performance constancy is important.

For illumination companies working across borders, this means acclimating to a market where cost benefits are slighter and product diversity must be built on manufacturing substance instead of price only.

Which Lighting Products Are Affected by the 2026 Tariff Reductions?

The 2026 tariff plan applies to a wide range of illumination related imports crosswise numerous regions. The most prominent changes include discounts for products initiating from ASEAN nations, Japan, South Korea, Australia, New Zealand, and numerous developing markets.

Table 1: Summary of 2026 Tariff Reductions for Lighting Products

| Origin Region / Country | Previous Tariff Range | 2026 Tariff Range | Key Impact |

| ASEAN Countries | 5.6% – 14.7% | 2.5% – 13.5% | Broad cost relief across lighting categories |

| Japan | 5.8% – 16.3% | 3.4% – 13.8% | Improved competitiveness for high-spec components |

| South Korea | 0% – 9% | 0% – 8% | Marginal but meaningful reductions |

| Australia | ~3% – 16% | ~2.5% – 15% | Incremental improvement |

| New Zealand | ~4% – 17% | ~3% – 16% | Slight cost optimization |

| Pakistan, Nicaragua, Ecuador, Serbia | Varies | Reduzido | Expanded sourcing flexibility |

These diminutions apply not only to finished luminaires but also to lighting control components, comprising sensors, connectors, and control interfaces.

How Do Tariff Reductions Influence Global Lighting Supply Chains?

Lesser tariffs decrease import expenses, but they also reform supply chain dynamics. As sourcing becomes more supple, producers get access to a extensive range of materials and components at competitive prices. Though, this same openness bids tougher competition from global contractors.

In practical terms, tariff discounts compress margins. Firms that depend merely on pricing advantages may struggle, whereas those proposing superior design, acquiescence, and dependability are better placed.

For outdoor lighting products, where lifespan costs matter more than initial pricing, supply chain decisions progressively highlight constancy and long-lasted performance over short-term savings.

What Role Do Photocells Play in Outdoor Lighting Performance?

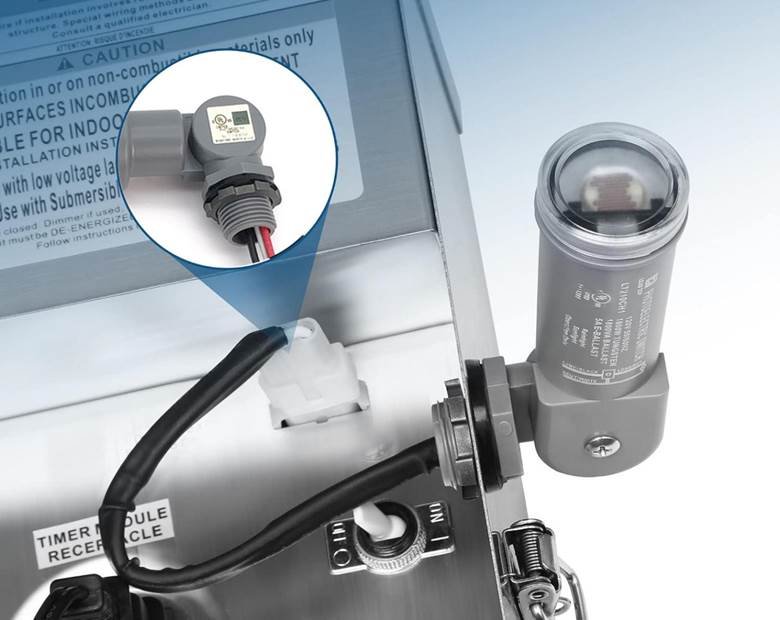

Among lighting control devices, the photocell for outdoor lighting remains one of the most crucial components. Fotocélulas decide when luminaires switch on and off, openly influencing energy depletion, light pollution, and system dependability.

In extensive deployments, unpredictable photocell behavior can result in astounded switching, needless daylight operation, or early failures. These problems may look minor individually but scale into noteworthy working ineffectiveness crosswise hundreds or thousands of fixtures.

For this reason, professional projects every so often specify uniform, engineering-grade photocells instead of generic alternatives.

Why Is Standardization Preferred Over Field Adjustment in Large Projects?

Professional outdoor illumination projects are trending toward standardized, factory-defined control parameters. This tactic reduces variability produced by on-site adjustments and lessens dependency on installer knowledge.

Field-adjustable solutions may offer suppleness, but they also introduce unpredictability—particularly in projects where control devices are fixed at height or in hard-to-access positions.

Standardized designs line up with the wider industry move toward certainty, acquiescence, and abridged operating risk, mainly as supply chains become more universal under lower tariff regimes.

How Do the 2026 Tariff Reductions Support High-Quality Industry Development?

The 2026 tariff changes are not purely about cost discount; they are an indication that the illumination industry is likely to contest on quality, dependability, and performance. By dropping trade barricades, policymakers encourage producers to upgrading manufacturing abilities and line up with global standards.

For purchasers, this means greater choice—but also greater obligation to assess products beyond price. In an open market, products that show verified performance and system compatibility naturally stand out.

While lighting control components denote a small percentage of total project cost, their impact on long-lasted operational expenditures is significant. Poor control accurateness can rise energy depletion, while untrustworthy components drive up preservation costs and service disruptions.

Table 2: Impact of Lighting Control Quality on Project Performance

| Control Attribute | Low-Quality Outcome | Engineering-Grade Outcome |

| Switching Accuracy | Inconsistent on/off timing | Precise and repeatable operation |

| Eficiência energética | Unnecessary power usage | Optimized energy consumption |

| Maintenance Frequency | Frequent site visits | Intervenção reduzida |

| Confiabilidade do sistema | Premature failures | Long-term stability |

| Lifecycle Cost | Higher total cost | Lower total cost over time |

In a market formed by tariff impact on lighting products, these long-lasted cost aspects increasingly outweigh upfront price differences.

Who Is Lead-Top and How Does It Fit into This Industry Shift?

Lead-Top specializes in engineering-grade Fotocélula NEMA solutions made for specialized outdoor illumination systems. Helping OEM producers, EPC suppliers, and infrastructure projects universally, Lead-Top emphases on dependability, constancy, and system-level compatibility.

The NEMA photocell has become a universal reference standard for outdoor illumination control, mainly in infrastructure-driven projects. Its homogeneous interface, electrical characteristics, and installation method support interchangeability and system-level compatibility.

From a project management viewpoint, NEMA-standard devices streamline procurement, decrease installation inconsistency, and permit anticipated performance crosswise different sites and regions.

As tariff diminutions rise cross-border component availability, obedience to recognized standards like NEMA becomes even more vital in maintaining system reliability.

In a market formed by 2026 tariff reductions and intensified competition, Lead-Top’s tactic line up with the industry’s swing toward high-quality, homogeneous, and performance-driven outdoor lighting control solutions that bring anticipated results all through their service life.